Default rate: what is it, how does it work and how to avoid it?

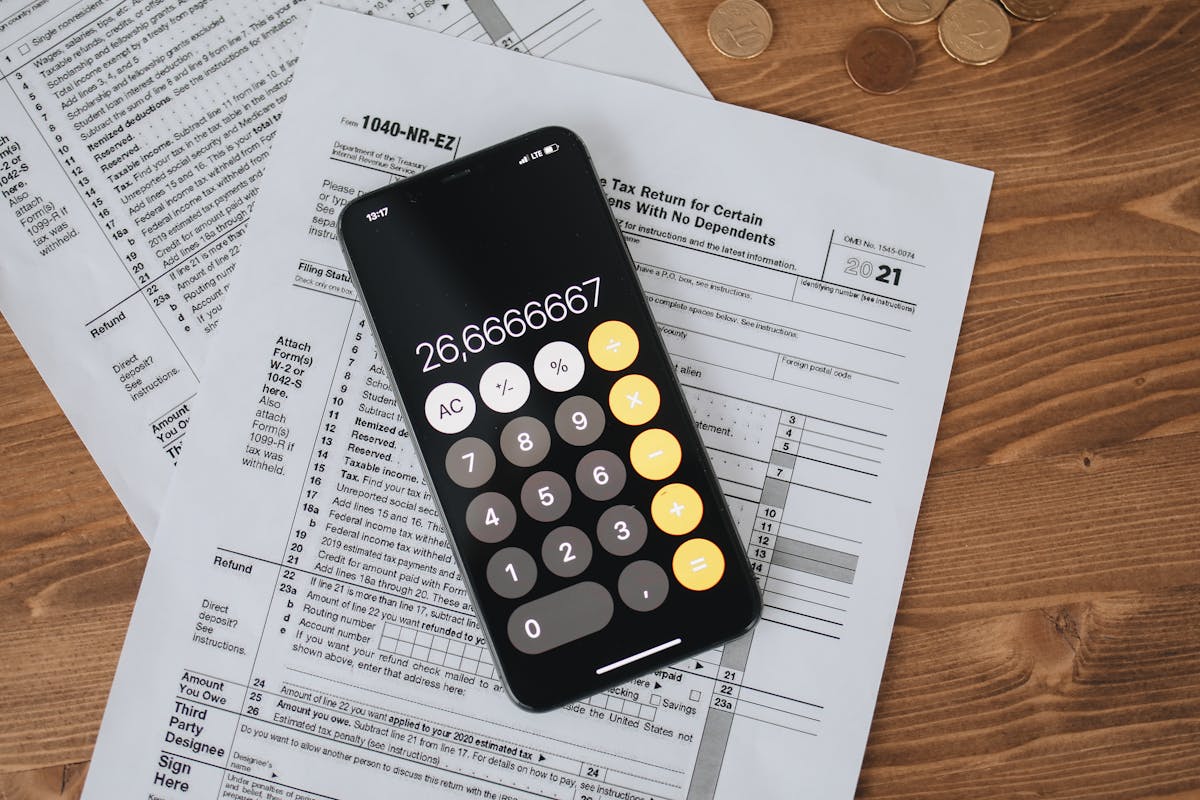

The default rate is an indicator that can help with financial organization and business management strategies. Find out how it works! Default represents a delay in fulfilling the consumer’s financial obligations, and can occur in installment or post-paid sales, for example. Since late payment tends to affect the business’s financial management, it is important to monitor these … Read more